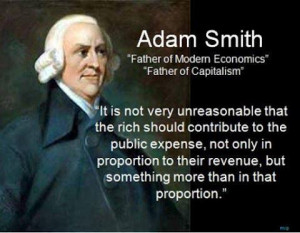

Tax System Quotes

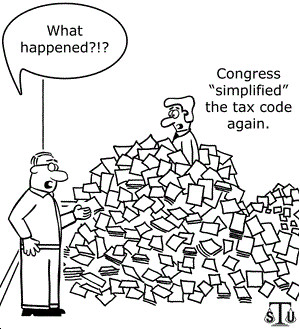

This country pays a price whenever our economy fails to deliver rising living standards to our citizens - which is exactly what has been the case for years now. We pay a price when our political system cannot come together and agree on the difficult but necessary steps to rein in entitlement spending or reform our tax system.