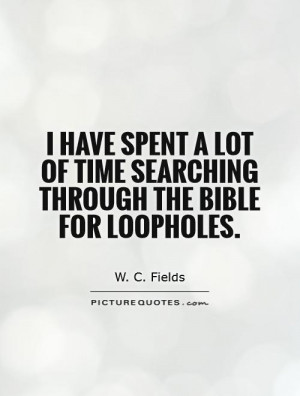

Loopholes Quotes

Corporate tax reform is nice in theory but tough in practice. It most likely requires lower tax rates and the closing of loopholes, which many companies are sure to fight. And whatever new, lower tax rate is determined, there will probably be another country willing to lower its rate further, creating a sad race to zero.

Fannie and Freddie made two-thirds of all subprime mortgages. That is not a free market institution. That entity, along with the Fed printing too much money back in '03 and '04, caused the housing collapse. So we need to take free markets seriously. That means we have to put an end to all these tax credits and tax deductions and loopholes.