Housing Market Quotes

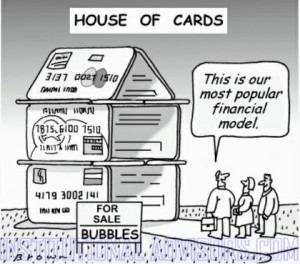

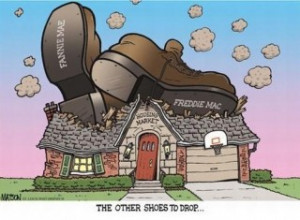

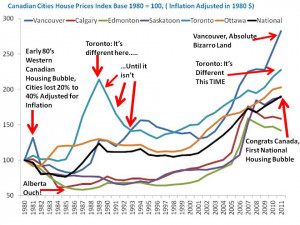

Too-easy credit and millions of bad loans made during the U.S. housing bubble paved the way for the financial calamity and Great Recession that followed. Today, by contrast, credit is too tight. Mortgage loans are particularly hard to get, creating a problem for the housing market and the broader economy.